Quarterly Results

Quarterly Results

Click here to download the complete financials

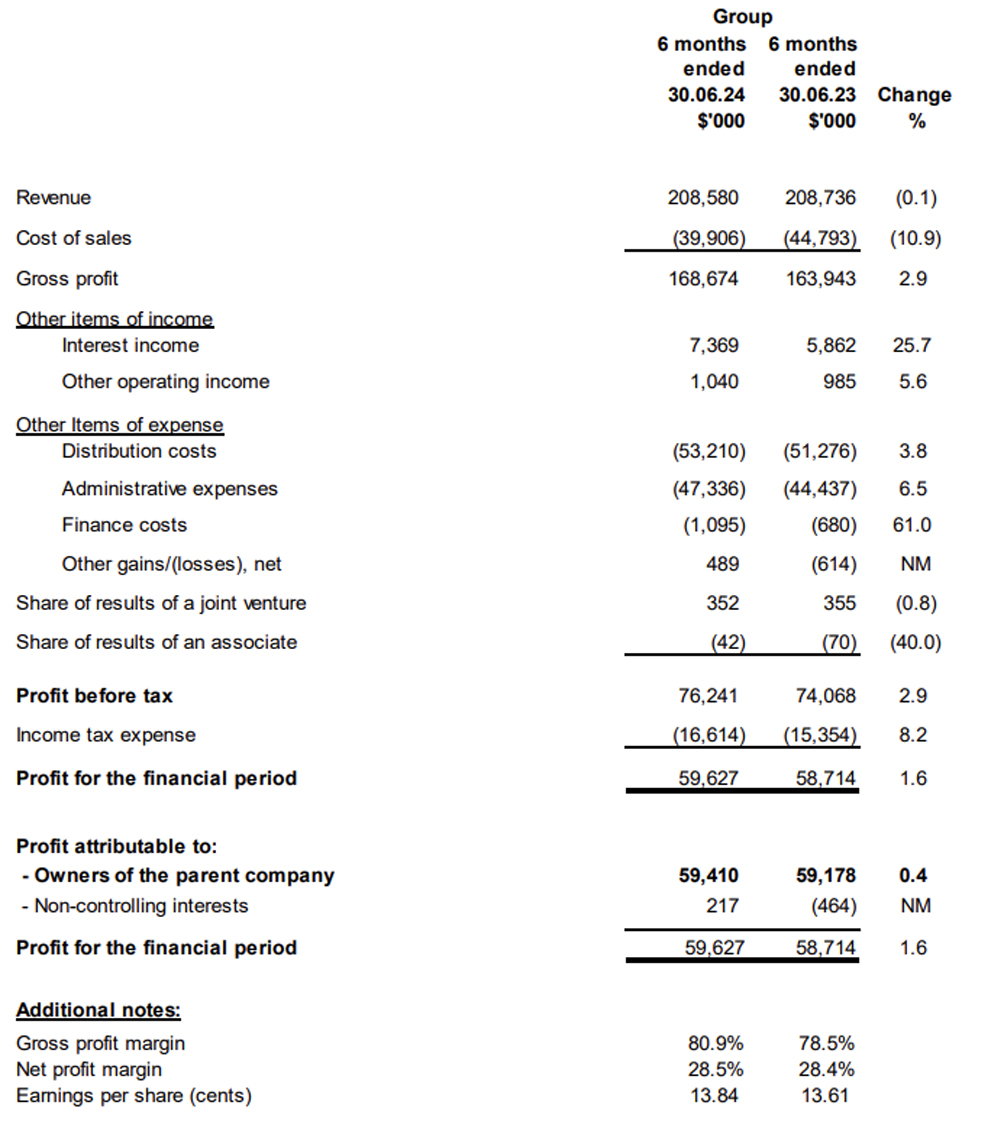

Condensed Interim Consolidated Statement Of Profit Or Loss For The Six Months Ended 30 June 2024

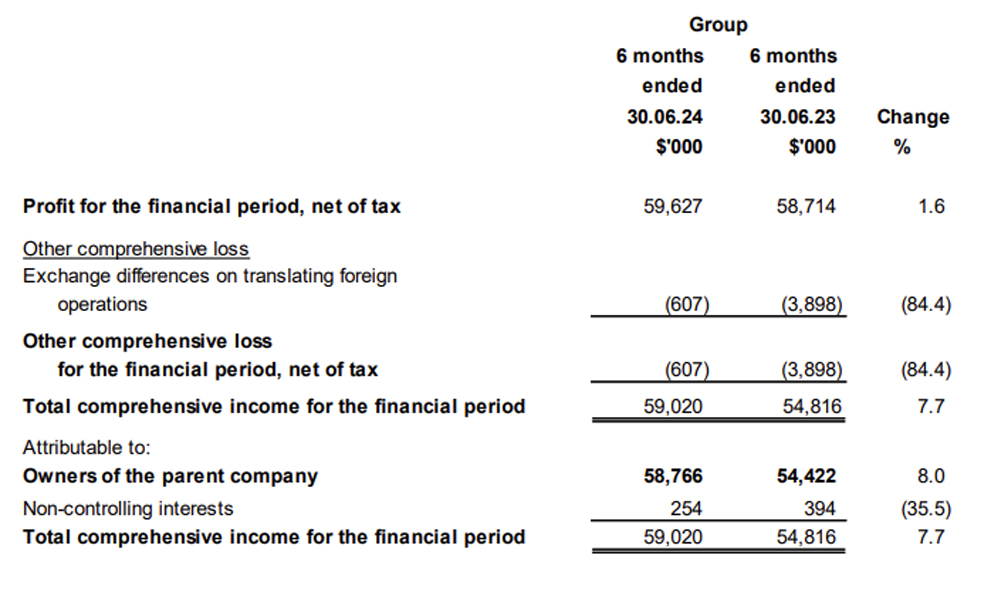

Statement of Comprehensive Income for the six months ended 30 June 2024:

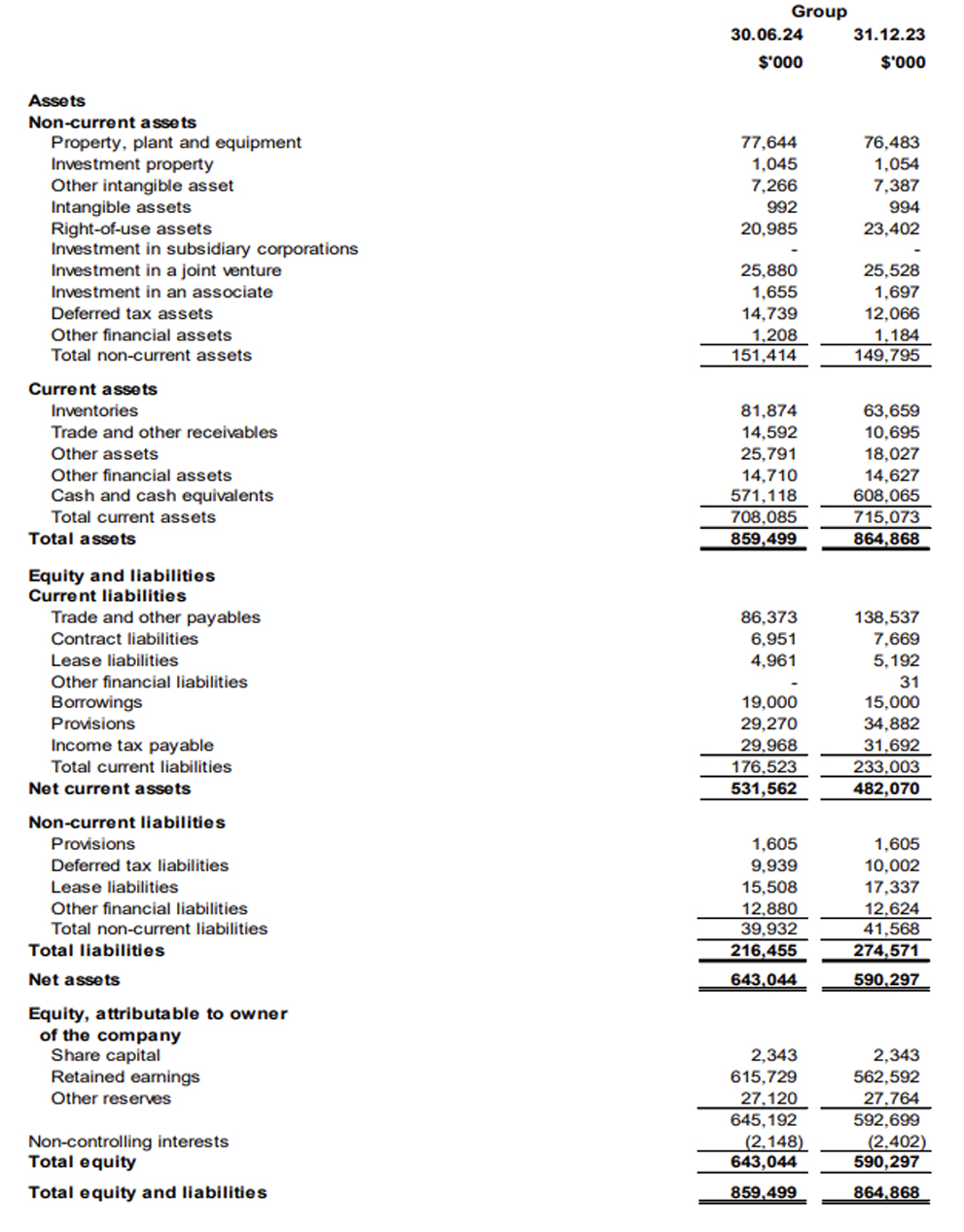

Condensed Interim Statements Of Financial Position As At 30 June 2024

Review of Performance

Review

The statements of financial position as at 30 June 2024 and the related consolidated statement of profit or loss, consolidated statement of comprehensive income, statements of changes in equity and consolidated statement of cash flows for the period ended 30 June 2024 and the selected explanatory notes (the “Condensed Consolidated Interim Financial Statements”) have not been audited or reviewed by the Company’s auditors.

Consolidated Statement of Comprehensive Income

The Group recorded profits attributable to the owners of the parent company amounting to $59.4 million in 1H2024, representing a 0.4% marginal increase as compared to the same period last year. A summary of the contributing factors include:

- Revenue 1H2024 remained flat at $208.6 million, compared to $208.7 million in 1H2023, due to lower sales in our China and Taiwan market, offsetting improvements in sales from Hong Kong, Singapore and Malaysia;

- Cost of sales decreased 10.9% to $40.0 million in 1H2024 mainly as a result of lower sales in our China and Taiwan market, offsetting higher custom duties and packing charges. Gross Profit Margin increased from 78.5% in 1H2023 to 80.9% in 1H2024 mainly due to higher contribution from higher-margin products for certain markets;

- Interest income increased 25.7% to $7.4 million in 1H2024, mainly due to higher interest derived from the Group’s cash placed in structured and fixed deposits with banks;

- Other operating income remained stable at $1.0 million in 1H2024;

- Distribution costs increased from $51.3 million in 1H2023 to $53.2 million in 1H2024, as a result of higher freelance commission from our direct selling segment due to improved sales, along with training, event and sales related expenses for the franchise segment;

- Administrative expenses for 1H2024 increased from $44.4 million to $47.3 million vis-àvis the same period last year, primarily attributed to higher management and staff costs for the expansion and retention of our management and staff base, in order to ensure our competitive edge and adaptability in the dynamic and ever-evolving industry landscape, offsetting the absence of expenses related to the Site Acceptance Test for one of the lines in our Tuas manufacturing facility which incurred in 1H2023 and was completed in 3Q2023;

- Finance costs was recorded at $1.1 million in 1H2024, mainly due to the higher interest expenses from bank borrowing due to a larger loan drawdown;

- Net Other Losses of $0.5 million in 1H2024 were primarily due to net foreign exchange gains from the revaluation of HQ cash and cash equivalents denominated in United States Dollars (USD) as a result of strengthening USD, offsetting allowance for slow moving stock for the period, while net other losses of $0.6 million were recorded in 1H2023, primarily due to fair value changes in the call and put options related to the Group’s UK joint venture company, Pedal Pulses Limited which were offset by net foreign exchange gains;

- Share of results of Pedal Pulses Limited, our UK joint venture, decreased to $352,000 in 1H2024 when compared to $355,000 in 1H2023, mainly due to slight lower share of profits for the period, offsetting amortisation expenses of intangible assets identified during the purchase price allocation exercise;

- Share of losses, of our associate, Celligenics decreased from $70,000 in 1H2023 to $42,000 in 1H2024 mainly due to lower operating expenses for the period;

- The Group reported income tax expense of $16.6 million in 1H2024 as compared

to $15.4 million in 1H2023 due to higher profit before tax generated by the Group. The

effective tax rate for 1H2024 was 21.8% as compared to 20.7% in 1H2023.

Consolidated Statement of Financial Position

Total assets (Group) decreased from $864.9 million as at 31 December 2023 to $859.5 million as at 30 June 2024, mainly due to:

- Decrease in right-of-use assets of $2.4 million mainly due to depreciation; and

- Decrease in cash and cash equivalents of $36.9 million due to reasons stated in the consolidated statement of cash flows section below.

This was partially offset by a $1.2 million increase in property, plant and equipment from $76.5 million to $77.6 million as at 30 June 2024 due to renovation costs related to the Group’s Supply Chain & Quality office and Taichung office cum regional centre, increase in deferred tax assets of $2.7 million due to higher unrealised profits from inventory, increase in inventories of $18.2 million due to stock replenishment from certain subsidiaries, increase in trade and other receivables of $3.9 million as a result of net GST/VAT receivables and pending transaction clearances from payment service providers and increase in other assets of $7.8 million due to higher advance payment made to suppliers when compared to 31 December 2023.

Total liabilities (Group) decreased from $274.6 million as at 31 December 2023 to $216.5 million as at 30 June 2024, mainly due to:

- Decrease in income tax payables of $1.7 million due to tax payments made during 1H2024;

- Trade and other payables which mainly consist of accruals for management and staff incentive and marketing events expenses, as well as service fees to third-party promotional companies for our Franchise segment, and freelance commissions for our Direct Selling segment, decreased $52.2 million due to lower sales-related expenses from the Franchise segment and management and staff incentives paid in 1H2024;

- Decrease in total lease liabilities of $2.1 million mainly due to payment of lease

liabilities; and

- Decrease in the provision of $5.6 million due to lower convention expense accrued.

The above decline was offset by the increase in borrowings of $4.0 million mainly due to additional loan drawdown from HQ.

Consolidated Statement of Cash Flows

1H2024 recorded net cash used in operating activities of $34.8 million, mainly attributable to the cash outflow from working capital changes due to lower trade and other payables as a result of management and staff incentives paid during the period, payment of sales related expenses for Franchise segment, decrease in the provision, increase in inventories and higher trade and other receivables due to reasons explained above, as well as income tax paid during the period.

Net cash flow from investing activities of $2.2 million in 1H2024 was mainly due to interest received and proceeds from the redemption of other financial assets, offsetting purchase of other financial assets and property, plant and equipment relating to renovation costs of the Group’s Supply Chain & Quality office and Taichung office cum regional centre during the period.

Net cash flow used in financing activities of $383.8 million in 1H2024 was mainly due to an increase in cash restricted in use as cash were held in escrow for the purpose of the selective capital reduction exercise, share buyback of $6.3 million conducted on 15 April 2024 and lease liabilities paid during the period, offsetting an increase in working capital loan of $4.0 million.

As at 30 June 2024, the Group maintained approximately $571.1 million in cash and cash equivalents.

Commentary

In line with multiple reports citing the likelihood of China’s economy facing more challenges in the year ahead due to the China’s declining exports and challenges in the property sector, management continues to expect to face strong headwinds for the Group’s largest market for the remaining quarters of FY2024.

The Group’s direct selling segment may also face challenges as economic volatility, supply chain disruptions, and changing consumer behavior etc., could influence customer demand, production plans, operating costs and overall profitability of the Group.

Barring any unforeseen circumstances, management maintains a cautious outlook for the next 12 months.

Other factors that may affect the Group’s performance in the next reporting period and for the next 12 months are as follows:

- The Group's subsidiary in China currently benefits from certain local incentives. Withdrawal or reduction of these incentives, or any other changes to the requirements in relation to the incentives could have an effect on the Group's profitability, especially considering the substantial contribution of the China market to the Group;

- While rolling out the Group’s inorganic growth strategy, professional fees may be incurred for services which include, but are not limited to, assessment of M&A targets, corporate actions, registrations and enforcement of the Group’s intellectual properties in various markets, and professional updates of various regulations the Group is subject to, etc;

- As the Group’s operations grow in scale and complexity, we expect more hirings which will increase management and staff costs. Coupled with higher expenses and depreciation in relation to the relocation/refurbishment of certain Regional Centres, and the Group’s Singapore HQ, logistics centre and packaging facility, we expect higher administrative expenses in the periods ahead;

- Given that the Group procures predominantly in the USD and maintains certain reserves in the same currency, fluctuations in interest rates and inflation could either benefit or adversely affect the value of the USD, thereby influencing the Group's earnings positively or negatively; and

- The Group's financial performance may be positively or negatively influenced by the fluctuating exchange rates of key markets in which it operates against the Singapore Dollar. Management is proactively monitoring the situation and will implement suitable measures to mitigate such risks.

Other ongoing factors that may affect the Group’s performance include, but are not limited to, timeline for product license registration/renewal in key markets, cyberattacks, natural or manmade disasters, unanticipated regulatory changes, climate change risks and disruptions from competitors and negative public opinion, whether real or unfounded.